“One-Day Loan for your Back to Back Closings”

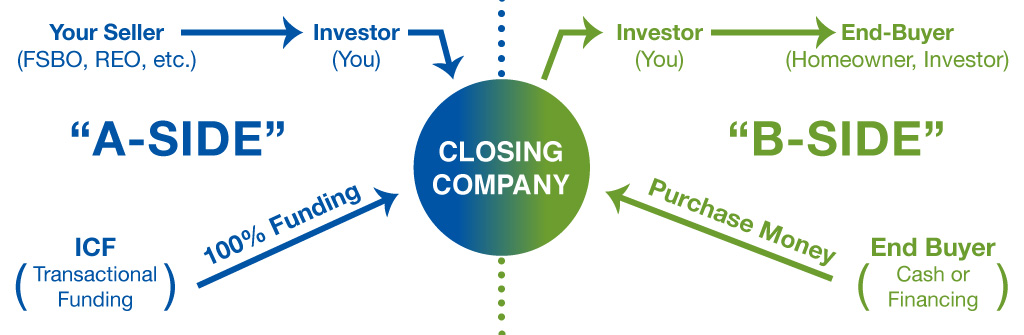

Designed to for real estate investors who need wet funding for a Back to Back closing, without using any of their own cash. Transactional funding is a “One Day Loan” to bridge the transaction.

Transactional Funding is a relatively new concept. Historically real estate investors would work with the closing agents to conduct “Simultaneous” Closings, where the End-Buyers (B Side) funds would be used for the Investors (A Side) purchase of the property.

With the increased scrutiny and recent regulatory actions, these types of transactions have become difficult, if not impossible. Even the most “Investor Friendly” closing companies have had to change their practices to comply with these pressures.

Transactional Funding provides an easy alternative to the transaction, by breaking the A Side purchase and B Side sale in to two completely separate transactions, each independently funded. This type of closing is typically referred to as Back-to-Back Closing, reducing the liabilities for all.

Simple Step by Step Process…

- The Investor (You) – Obtains a contract to purchase the property from the Seller

- The Investor (You) – Obtains a contract to Sell the Property to the End-Buyer

- The Investor (You) – Opens the file with your chosen Closing Company (must use same closing company for both sides of the transaction).

- The Investor (You) – Submit the Transaction Form and both Contracts to ICF for funding.

- ICF works directly with the Closing Company to arrange the funding of the A Side.

- The Closing Company – facilitates the closings of both the A Side and B Side transactions the same day.

- When both transactions are closed and disbursement has been approved, the Closing Company will distribute the ICF funds to the original Seller, and distribute the end-buyers funds to payoff ICF and pay the remaining Profits to you, the Investor.

Available for both Residential and Commercial properties, Transaction Funding is the perfect solution for Short Sales, Wholesalers, and Flippers to simplify the closing process, eliminate the headaches and drive more profits.

Program Highlights:

- Simple Loan Submission Process

- NO Credit Approval Requirement

- NO Appraisal needed

- 100% Funding (including Purchase Price, Fees and Closing Costs)

- Quick closings (3 – 5 business days after submission)

Pricing Structure

- $1500.00 Flat Fee up to $100,000

- 1.5% of Loan Amount over $100,000 – $500,000

- 2% of Loan Amount over $500,000

- Volume pricing available after the first 10 transactions.

Guidelines

- Arms Length transactions ONLY

- Max Loan $1,000,000

FREQUENTLY ASKED QUESTIONS

No, our program does not allow for terms beyond 1 day. We may provide a term loan if in our lending area, see our Bridge Loan program.

There is a $49.00 fee charged at time of submission for a Background check. All other fees are collected upon successful closing.

No. Transactional Funding is a loan and will typically raise a flag with the closing company, if the contract states it is a cash transaction.

Ready To Submit Your Deal?

We provide Transactional Funding for your real estate flips throughout the US, with few exceptions.

It’s as easy as 1, 2, 3….

Step 1 – Contact us to review the overall project at

303-500-7088

or complete the contact form and we’ll reach out to you as soon as possible.

Step 2 – Collect & Submit Documentation

Step 3 – Close your deal, typically within 2-3 days.

Not quite ready to submit but have questions? Use the contact form and we’ll respond pronto.